Getting it Right

We put face time in with our investors.

Not the iPhone kind, real person-to-person ones, across-the-desk conversations where things happen. Old school, we know, but we’re not over the old way of doing things. The point is them: their wants, their product preferences, ROIs, pain thresholds, economy, cycles, family, politics, lifestyle, anything and everything to learn how to keep them in the game.

Results: Heatley Capital investors go back 30 years

“Works hard, shoots straight, and tells you what you need to know, when you need to know it. That’s what I appreciate most about Heatley Capital.” --Royce Hunter, Investor since 1988

PORTFOLIO

RECENT PROJECTS

CASE STUDIES

Hilton College Station

Bryan/College Station, Texas

2.4X Investor Return Multiple

25.81% IRR

4 Year Hold

Investment date: September 2010

313-room and conference center

Purchased off market at 50% of replacement costs

Averaging a 12% annual return to investors

OUR HISTORY

1995

1995 1997

1997 1999

1999 2006

2006 2010

2010 2012

2012 2020

20201995

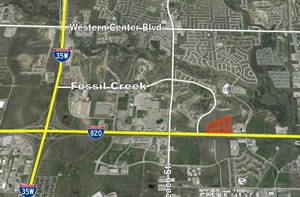

Fossil Creek / Loop 820

Fort Worth, Texas

2.87X Investor Return Multiple

21% IRR

Investment Date: January 1995

Land note with semi-annual interest payments

1997

Harbour Monticello Estates

Fort Worth, Texas

6.69X Investor Return Multiple

25.9% IRR

Investment Date: July 1997

640 acres of land

Sold 216 acres shortly after closing for 3.6 times the original purchase price

Developed 240 acres into single family lots

Sold remaining 184 acres nine years after the acquisition for nearly seven times the purchase price

1999

2000 Corridor Alliance

Fort Worth, Texas

2.44X Investor Return Multiple

11.2% IRR

Investment Date: December 1999

503-unit storage facility

2006

Denton / Loop 288

Denton, Texas

2.98X Investor Return Multiple

490% IRR

Investment Date: February 2006

40-acre commercial tract

Sold property within six months

2010

Hilton College Station

Bryan/College Station, Texas

2.4X Investor Return Multiple

25.81% IRR

Investment Date: September 2010

313-room and conference center

Purchased off market at 50% of replacement costs

Averaging a 12% annual return to investors

2012

Trophy Club Village Centre

Trophy Club, Texas

2.4X Investor Return Multiple

22.25% IRR

Investment Date: October 2012

Two-phase development, approximately 16,000 sq ft medical and professional center

2020

Governor's Pointe

Mason, Ohio

2.37X Investor Return Multiple

11.14% IRR

Project Closed: October 2020

100% Occupied, 360,001 square foot retail center anchored by Lowes Home Improvement Center